Investment

We are looking for investment to develop a loan App: Delling

Attracting investors to our company means more than just gaining additional capital. Investors can provide new opportunities, add valuable skills and perspectives, and help elevate the company to new heights. We welcome investors who share our vision of transforming the micro-lending landscape through innovative technology and financial inclusion. Our goal is to empower borrowers with quick and accessible micro-loans while delivering strong returns for our investors.

In our one year of involvement in fintech, we have developed expertise in payment gateway and fund process management, and have leveraged AI technology to create our Loan App. By investing in our company, you will be joining a team that is passionate about revolutionizing the way people access financing. We look forward to partnering with investors who share our values and commitment to innovation.

What does Delling do?

The Loan App facilitates private microloans among individuals, with all aspects of the borrowing process streamlined and automated.

Features of the Loan App include:

- Record history

- Management of interest rates

- Management of late fees

- Management of legalities

- Money transactions

Borrowers can apply for microloans in a matter of minutes, and with lenders providing automated instructions, the borrowing process is quick and efficient. While borrowers can receive their money in just minutes, it may take a day or two for the funds to appear in their bank account, depending on their bank's process.

We are committed to providing a user-friendly and secure platform for micro-lending and continuously work to enhance the app's features and functionality.

Why Delling?

Today friends, colleagues, and classmates, ... are lending and borrowing directly from each other. This is how they do it:

- Meet or call each other

- Bring reasoning to get the loan

- Negotiate the amount

- Negotiate the due date for returning the money

- Negotiate the late fee or interest rate

- Use an account to transfer money

Both borrowers and Lenders have certain challenges with the current way of getting and receiving a loan.

Common problems for borrowers

1. Lender availability

At the time we are in need, the lender is not available on phone or to meet.

2. Not easy to request and Negotiate

People are not comfortable with asking for money face to face or negotiating the due for returning the money.

3. Difficult to Manage all the Calculations

People need help calculating late fees, and interest rates, especially if they have different loans.

Common Problems for Lenders

1. Have a secure/proper record

Some lenders need to keep a screenshot of payment or sign a paper when lending money to their network. Over time, some lose them or can't find them especially if they lend money to several people.

2. Manage late fees and interest rates

It is challenging for lenders to negotiate and how to deal with late fees and interest rates.

3. Legalities

In case of problems with payments, it is difficult and usually impossible to pursue through authorities to give a small amount of money. So, usually, lenders will give up and cannot do anything about it.

4. Payment/Transactions

Most of the time for a small amount of loan people need to go through complicated payment methods, which have high costs and it takes time. In Sweden people use Swish, but in many countries, there are certain restrictions: Almost 2 billion individuals and 200 million small businesses lack access to formal savings and credit worldwide.

Business Overview

Market Cap

“Lending market has grown from $715bn at the end of 2019 to $1.164tn today.”

“The global micro-lending market size is expected to reach USD 86.82 billion by 2030, growing at a CAGR of 13.4% from 2022 to 2030.”

—Berkshire Hathaway, Business wire

The confidence of reliable sources and past statistics ensure the growth of the market for P2P micro-lending.

In addition, the advancement of technology and availability of apps and the internet has been growing quickly in recent years which lead to a need for these services to be more available and reachable through the current channel of communication, Apps, and mobile devices.

The global P2P lending market size was valued at USD 82.3 billion in 2021 and is expected to touch USD 804.2 billion by 2030.

Business Roadmap

We have a clear and structured approach to building our business. We have defined three distinct phases of development, each with its own goals, milestones, and budget.

Phases

By following this phased approach, we can manage our resources effectively, stay on track, and achieve success at each stage of our journey. We believe that we can achieve our goals while managing risks and maintaining a strong financial position. We are confident that our product, team, and strategy will enable us to build a successful business and create value for our customers and stakeholders.

Phase 1: Startup Phase

During the startup phase, our primary focus is on developing and releasing the beta version of our app. Our goal is to create a product that meets the needs of our target audience while keeping costs under control. We will invest in app development, server hosting and data storage, legal and regulatory fees, and basic office and administrative expenses. Once we have a functioning beta version, we will move on to the next phase.

Phase 2: Growth Phase

In the growth phase, our goal is to build a solid user base and establish our brand in the market. We will invest in marketing and advertising, hiring new team members, and improving the user experience of our app. We will use data and analytics to measure our success and adjust our strategy accordingly. By the end of the growth phase, we aim to have a strong user base and a clear path to profitability.

Phase 3: Expansion Phase

In the expansion phase, our goal is to scale our operations and take our business to the next level. We will invest in office space, infrastructure, and advanced technology to support our growing team and user base. We will explore new markets and partnerships to expand our reach and revenue streams. We will focus on building a sustainable business that can continue to grow and thrive in the long term.

Revenue Model

Our app offers a peer-to-peer micro-lending platform for users to lend money to each other, with a flat fee of 10 SEK per transaction. We aim to keep our pricing competitive and accessible to users, while still generating revenue for the platform's sustainability.

In addition to the free basic use of the app, we offer a pro feature of customizable loan terms. This feature allows users to customize their loan terms and repayment options, offering greater flexibility and control over their borrowing experience. The pro feature is priced at 100 SEK per month or 1,000 SEK per year.

We believe this pricing model strikes a balance between generating revenue for the sustainability of the app and offering value to our users. Our approach is to keep our fees and prices low, ensuring that our app remains accessible and appealing to a wide range of users. We will continually evaluate our pricing structure based on user feedback and market demand, ensuring that it remains competitive and sustainable over time.

Financial Forcast

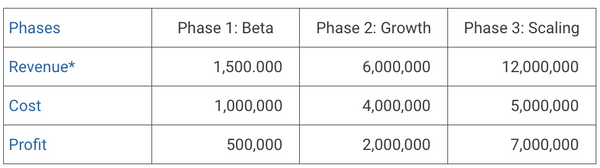

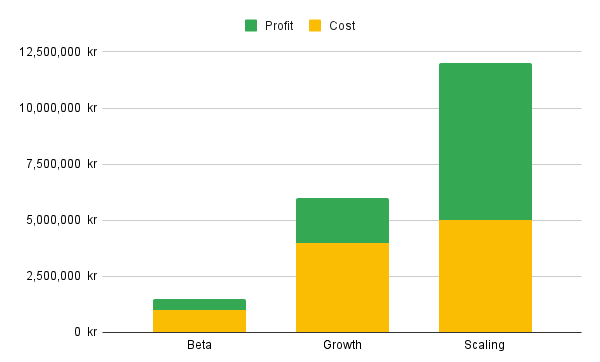

Our financial forecast outlines our projected revenue, costs, and profits for the beta, growth, and expansion phases of our business. This information is based on market research and our current product development stage. We believe that these projections are achievable, and we are committed to delivering on these goals. Please refer to the table and chart below for a more detailed breakdown of our financial forecast.

* Revenue calculated based on an average of 100 kr/m considering the distribution of acquisition among the year concludes on an average 6-month subscription per user.